SUCCESSFUL LEADERS ALWAYS LOOK TOWARD THE FUTURE.

Around 30 years ago, our company’s namesake, ResultatPartner (Result Partner), pioneered a revolutionary sales training program for businesses of every size. Today, our proven sales training program has made us one of the leader in sales and management training, with thousands of trainings run since then.

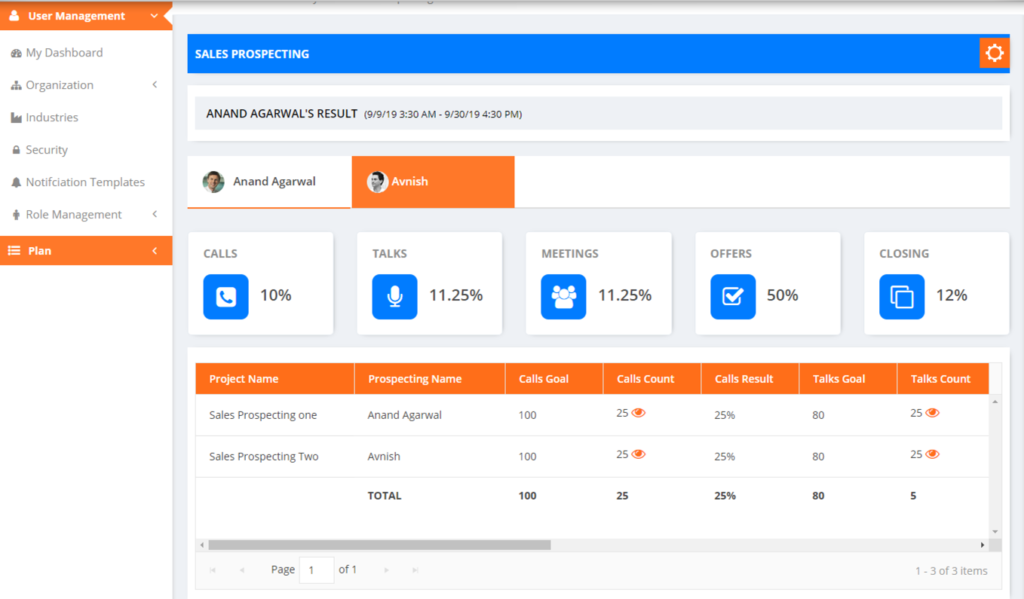

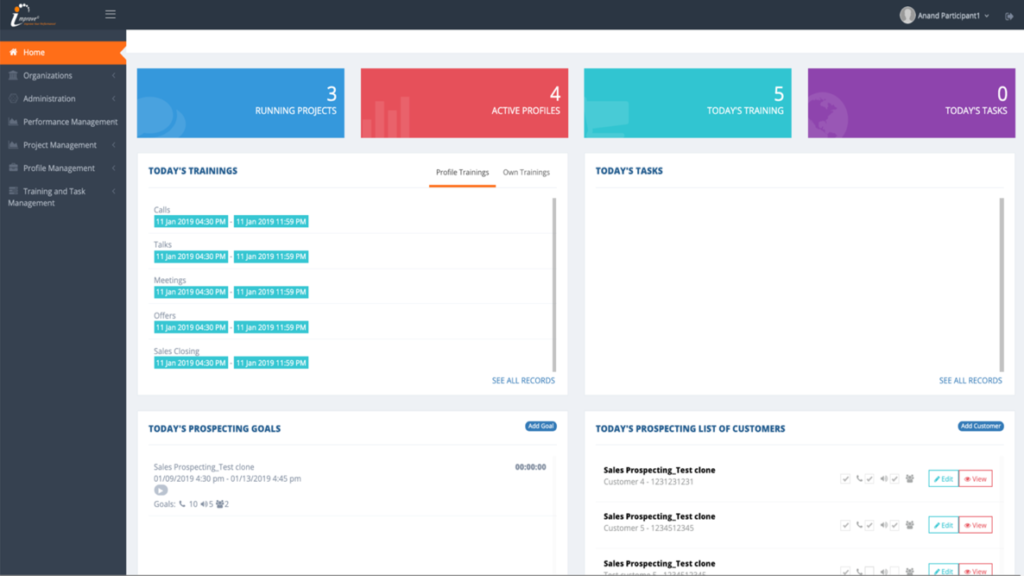

While much has changed in the business world since then, ResultatPartner and Improve Training has always kept pace. Under the leadership of Ronny A. Nilsen, CEO and Founder, ResultatPartner Training continues to innovate through our new company; Improve Performance International targeting Grown-up and mature Businesses (enterprise), Startups and Scaleups. In that spirit, we recently launched an “online digital portal” that our customers and franchisees can use in addition to face-to-face training. And we will continue to incorporate online reinforcement, online learning management and increased mobile availability.

With our unique reinforcement model, our Customers and Franchise Owners and Associated Partners can give businesses a competitive advantage by helping create a highly skilled sales force and inspiring management and leadership to excellence.

KEY TO SUCCESS = “PASSION TO SALES”

At Improve Startups we’ve earned a reputation for providing sales people with the insights they need to dominate in today’s hyper-competitive selling climate.

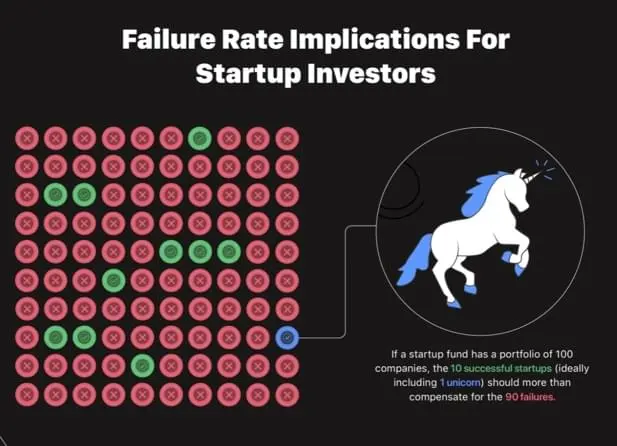

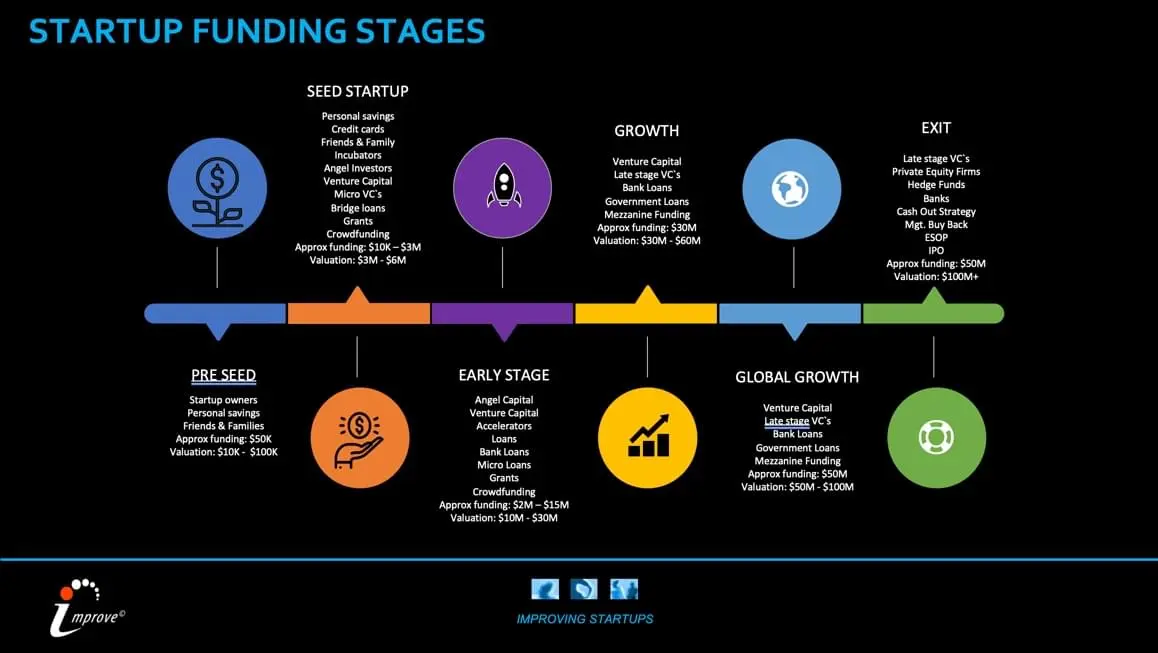

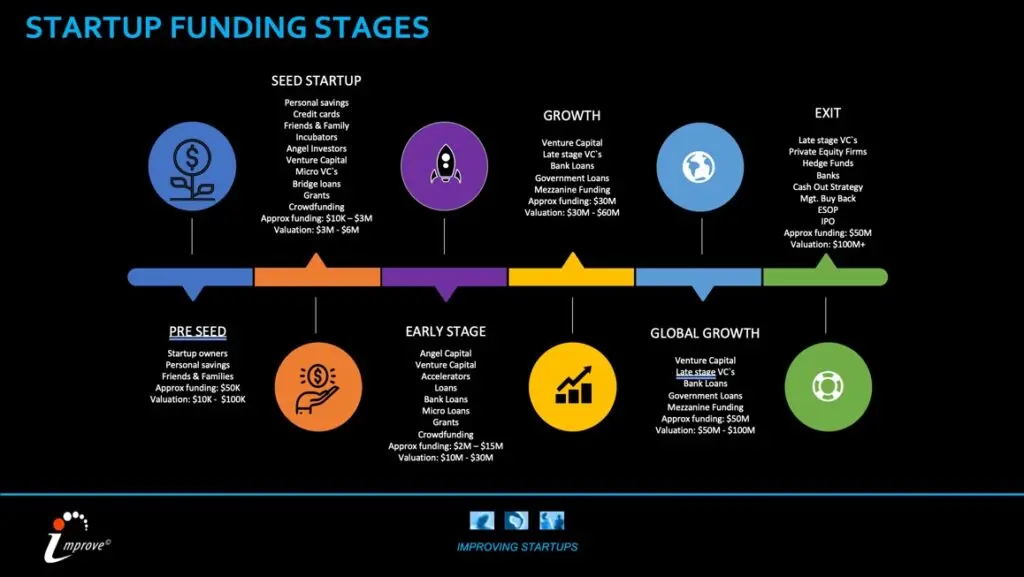

We believe key to success for Startups and Scaleups companies is driven by a “passion to sales” and the fact is; any employee should be aware of a companies growth is based on sales. Thats why we focus on sales improvement as one of the key elements boosting startups and scaleups.

Improve Startup is a research based sales training, sales coaching and sales consulting firm that is one of the leaders in the integration of proven science and sales. Based in Oslo, Norway, we study the scientific disciplines of social psychology, communication theory, cognitive psychology, social neuroscience, cognitive neuroscience and behavioral economics since our founders established ResultatPartner (ResultPartner) back in 1991. We then take the repeatable and predictable principles, which science has proven to create and enable influence, out of the laboratory and academic journals and apply them to selling.

What’s more, we have conducted original scientific research that identified the mental process that the human brain goes through when making a buying decision. We then deconstructed this internal decision making process into clear, manageable steps that equip sales people to literally sell the way that their prospects’ brains are hardwired to buy.

When sales people base their sales activities and behaviors upon proven science, the results are always astounding: sales cycles shorten, market share grows, and sales production skyrockets and it repeat sales.

WHY IMPROVE STARTUPS?

We aim to help the world’s leading companies drive predictable revenue and profitability growth by optimizing sales organization performance.

WHY ARE WE DIFFERENT?

Our clients tell us we are unique for a variety of important reasons including:

- Deep customization – actually it`s all about YOUR business, right?

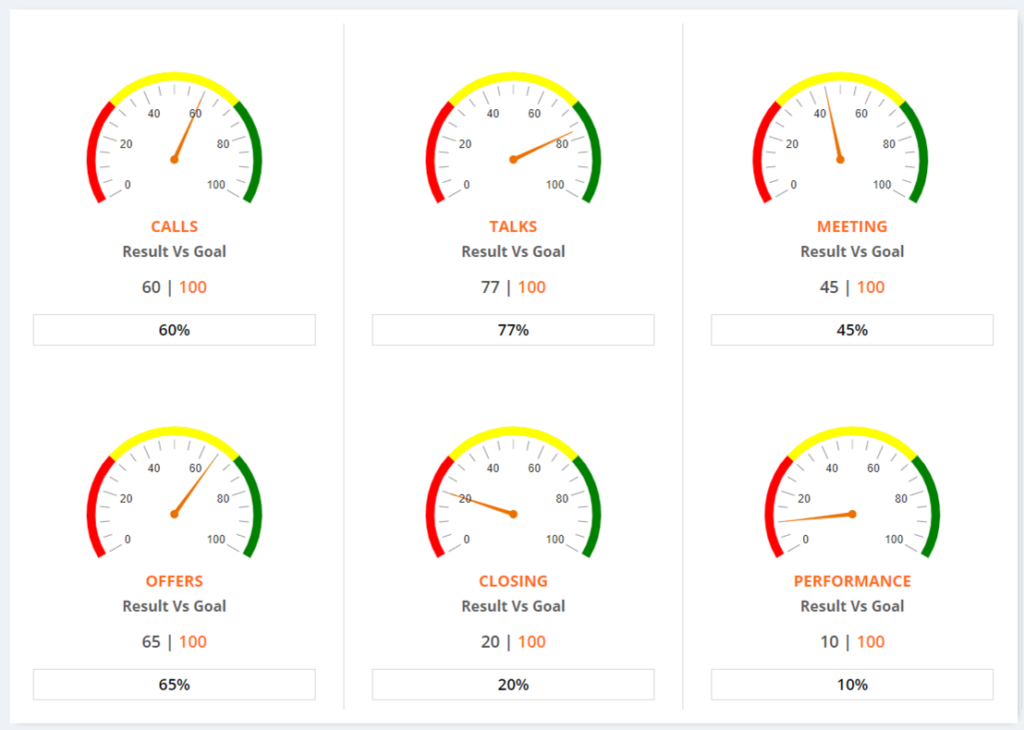

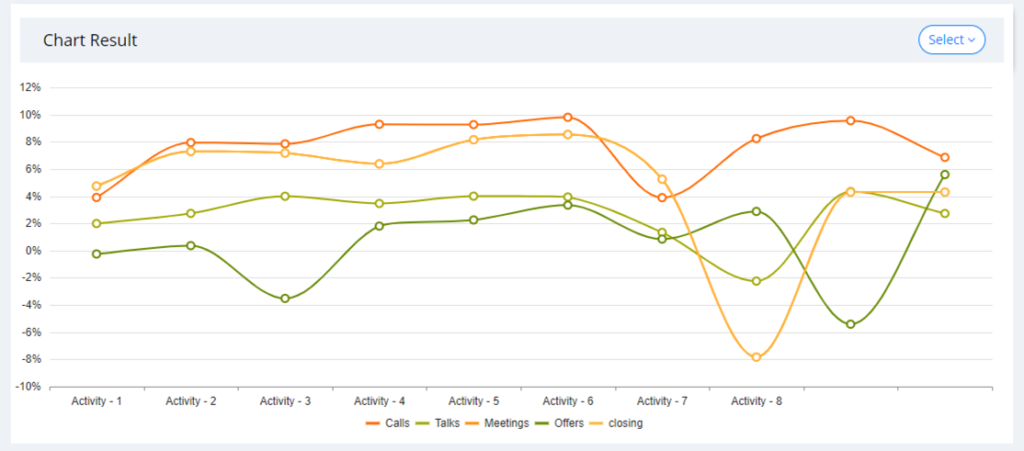

- Improve Performance and Training Systems (IPTS) – systematic and measurable driving performance!

- Improve Performance Group; Our “Performance community”.

- Industry specialization – we “know or adopt” to your industry.

- Interactive learning – telling is not selling; showing and interactions make the difference.

- Extensive curriculum – best fit!

- Traditional and digital delivery modalities – digital portal connecting people, learning and relations.

- Experienced and expert facilitators – at least 10 years of proven results and experience.

- Results in initiating and sustaining change through the organization – implementing the hard stuff in a simplified way!

Please share on social network