STARTUP FUNDING STAGES

Running a startup business is tough. That’s why 80% fail.

Our mission is to improve Startups and Scaleups by developing a digital platform connecting people, processes and performance. And its vital you get off on the right foot otherwise you will most likely be part of the stats. So lets start with some definition.

Startups

The term startup refers to a company in the first stages of operations. Startups are founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. These companies generally start with high costs and limited revenue, which is why they look for capital from a variety of sources such as venture capitalists. (Source: https://www.investopedia.com/terms/s/startup.asp)

Scaleups

A scaleup (company) is a company who has an average annualized return of at least 20% in the past 3 years with at least 10 employees in the beginning of the period (OECD, 2007)[1]

A scaleup can be identified as being in the “growth phase” life-cycle in the Millers and Friesen (1984)[2] life cycle theorem, or the “Direction phase” in the Greiner growth curve.

The importance of scaleups and the rise of their terminology can be found in the study of the World Economic Forum which found that not all startups make it big, but the ones that do greatly impact society by means of new technology, services and increased employment.[3]

To aid this rise, instead of large startup incubators, policy makers are more and more focusing on scaleups since they are the ones that add value.

Source: https://en.wikipedia.org/wiki/Scaleup_company

Startup incubator

A startup incubator is a collaborative program for startup companies — usually physically located in one central workspace — designed to help startups in their infancy succeed by providing workspace, seed funding, mentoring and training. Startup incubators are usually nonprofit organizations, often associated with universities and business schools who extend invitations to students, alumni and members of the community to take advantage of the program. Some popular incubator programs include Y Combinator, TechStars and Excelerate Labs. In Norway you will find a great list here.

According to SCORE, incubators often provide access to the resources needed to launch a business. This may include office space and equipment, utilities (including internet service) and discounted or free professional services, such as accounting and legal help.

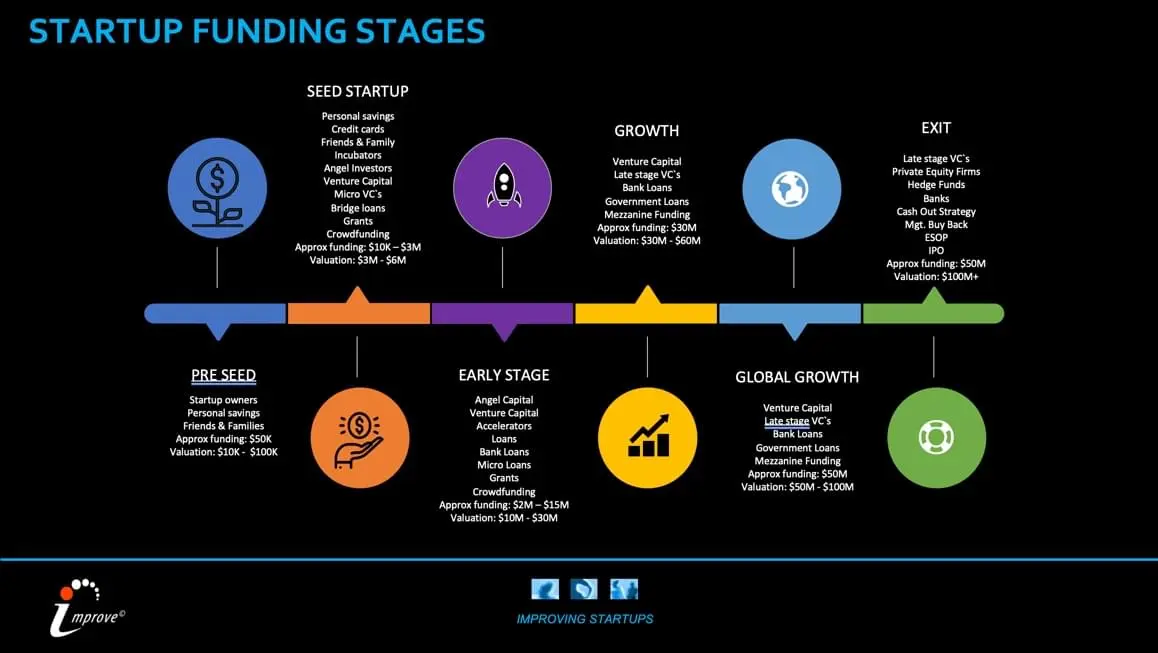

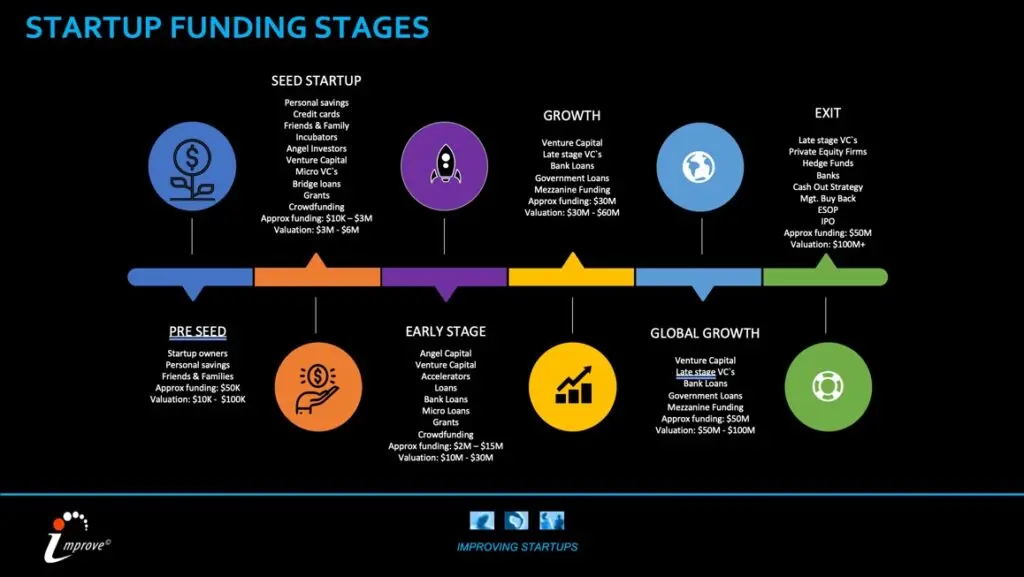

Startup Funding Stages

There are 6 core stages for your Startup journey and during each you will see different ways of funding your business.

Funding stages

Based on the raising purpose, startup funding rounds are divided into the following stages:

- pre-seed/seed;

- series A, B, & C;

- and IPO.

Seed stage funding

Pre-seed funding is when founders are trying to give their idea the initial push and often invest their own money.

It is followed by the Seed stage, where founders attract so-called angel investors. These people provide funds for further research, testing market needs, hiring a team, and production start.

At the seed stage, tech startups can aim at anywhere between $500K and $2 million investments, depending on their needs and presentation. Investors are ready to take risks, and typically invest in a number of startups. Those that go through then receive additional capital.

Some of the well-known companies considered for this stage are Y Combinator, 500 startups, SV Angel, and Techstars.

Series A

Next comes round A. It is focused mainly on the startups that have a proven business model, decent customer base, and are already generating profit.

The investments at this stage can start from $3 million and require a specific strategy to reach higher ROI. Typical investors here are venture capital firms that ask startups to show real data and progress received from previous investments. They want to see the startup turning into a valuable money-making machine ready to scale and get to the next level.

Series B

Round B helps startups turn into enterprises.

At this point, they’ve already matured, have a large user base, and are looking for VC-level participation. Investments at this stage can range anywhere around $10 million and up (Mixpanel raised $65 million series B). This stage is all about scaling up the team and exploring new markets.

Some of the biggest investors here are Accel, Insight Venture Capitals, and Sequoia Capital and from Norway we find; Alliance Venture, Fynd Ocean Ventures, Hadean Ventures, Investinor, Idekapital, Northzone.

Series C

Moving to round C implies an even higher level of expansion.

The companies are already successful, value $100+ million, and are aiming to receive equal funding (again, Magic Leap has raised almost $1 billion). As one of the last funding stages, round C includes not only extending current project capabilities but creating new products. So, prepare to work with the largest VC firms and corporate-level investors that are far more demanding.

Companies at this stage are getting their exit strategies ready to smoothly approach IPO.

IPO

The final stage of a startups’ existence, initial public offering (IPO) is the process of opening a private company’s shares to the public.

This unlocks a vast amount of funding available on the public market along with a new level of transparency. However, it also means additional complexity because now you have to deal with shareholders in addition to investors. Such relationships require a lot of effort and you can expect it to be challenging and expensive.

Investors

What different types of investors are there for funding your startup? There’s more than one type of investor to fundraise from. So, how are they different? Which may be a good match and when? Below is a list with the different types of investors:

1) Friends & Family

The first type of investor entrepreneurs should be approaching at the very beginning are friends and family and close personal contacts. At this stage there is very little hard evidence and proof to base a real investment or funding on. They are essentially investing in the idea, and far more importantly – you. These are the people that already know you, like and trust you and believe in you the most. This type of investor may not provide a lot of money. It could be in the range of $1,000 to $200,000. Though if you can’t raise money from this group, other investors are probably going to ask themselves why.

2) Banks & Government Agencies

These aren’t true investors like the others on this list, but they can be sources of capital. Traditional banks are generally not an easy source of capital for early stage startups and small businesses. However, as you gain traction they may offer business credit cards, lines of credit and merchant advance loans.

There may also be government programs providing grants for certain types of projects. That doesn’t mean that bringing in this type of capital will be any easier, and loans require repayment, often when you really need as much liquidity and slack as possible. They won’t require giving up equity in your company, but they can impact your profitability, which may show up when you try to raise money from other investors later.

One thing to note about government programs is that in many instances the come with certain restrictions and limitations which may be burdensome for startups. With this in mind founders should review very carefully what those expectations are.

3) Angel Investors

Professional angel investors are normally approached when it comes to the seed round and beyond. They are willing to fund smaller operations than VCs, may be more flexible in terms, and can offer a lot of value in wisdom and connections.

Angel investors can be approached directly online, at live pitch events, and through introductions from other startup founders.

4) Angel Groups

Angel groups have been increasing. They have become more popular and more organized. These are groups of angel investors who band together to make investments in startups. This enables them to invest with more confidence, with larger check sizes, and with lower exposure to risk.

5) Accelerators & Incubators

These vehicles can ultimately be a gateway to a variety of the types of investors on this list. If accepted into one of these programs you may receive anywhere from $10,000 to $120,000 in seed money to cultivate your idea and gain traction, while benefiting from additional knowledge and resources. If everything is going well, you’ll be pitching larger investors and be introduced to funding sources during their demo days that can help take you to the next level. Just be ready to hustle, these programs want to speed you on the way to the next stage quickly.

6) Family Offices

Family offices are increasingly being drawn to the advantages of investing in startups. However, as some of the most successful entrepreneurs that have appeared as guests on the DealMakers Podcast have pointed out, as investors, family offices can have quite different interests and game plans. Each can be very different.

Working with them can be very different depending on who is managing the decisions and process. Taxes, long term multigenerational investing, prestige and income may be more important for these investors than others on this list who are pushing to an earlier exit.

7) Venture Capital Firms

VCs are the holy grail of investors for fundraising entrepreneurs. They come with the biggest checks, the most power to fuel success and gaining market share, and most juice when it comes to achieving more credibility and visibility.

More venture capital firms are looking at and are participating in earlier funding rounds. Though it is much more likely these investors will show up and be secured in Series A, B and C fundraising rounds than earlier.

Do note that not all of these firms are created equal. The best match can be influenced by location, the timeline of their funds, their interest and expertise in a certain field, their power to help you get to the next stage and of course, how they treat their founders.

8) Corporate Investors

Investing in startups carries a variety of benefits for big corporations. Including supporting their own growth numbers, diversifying assets, and identifying talent and technology which can help them fend off industry changes and fuel revenues and profits. Some have funds to invest in outside startups. More are launching their own accelerator and incubator programs and ecosystems for cultivating these opportunities.

These investors can be great allies in taking your business to the next level. Though they can be quite different to work with, and any integration or collaboration on sales channels, systems and customer bases needs to be approached carefully and with a lot of patience.

Founding entrepreneurs and corporate investors often have completely different styles and perspectives. It’s going to be vital to learn to understand each other and have some boundaries set up when going in, if this is going to be an enjoyable relationship.

How to finance your startup in Oslo?

Oslo Business region is a great website covering the do`s and don’t`s in the Startup world. You may read more about it here.

Summary

As you can see from this list, there are a wide variety of very different types of investors for funding startups. Some are very specialized in the stages and funding rounds they will invest at. Though these lines are increasingly blurring. Think of this as a ladder, not an A or B menu list.

As the startup or scaleup grows different sources of capital will be more advantageous and valuable to fueling that next level of growth. Understanding these differences will be invaluable for an efficient fundraising campaign and targeting the right investors at each raise.